Affordable Care Act Updates: Pay or Play Penalties Will Increase in 2023

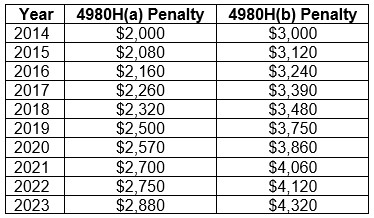

On Aug. 16, 2022, the IRS updated its FAQs on the ACA's employer shared responsibility rules to include updated penalty amounts for 2023. These penalty amounts are adjusted annually.

Under the pay or play rules, an applicable large employer (ALE) is only liable for a penalty if at least one full-time employee receives a subsidy for Exchange coverage. Employees who are offered affordable, minimum value coverage are generally not eligible for these Exchange subsidies.

4980H(a) Penalty:

This penalty is incurred when an employer fails to offer coverage to “substantially all” (95%) of its full-time employees. This is assessed against the entire full-time employee population.4980H(b) Penalty: This penalty is incurred when coverage is not offered to all full-time employees, is not affordable, or does not provide minimum value. This is assessed against the individual employee.

For 2023, the 4980H(a) penalty is adjusted to $2,880 and the 4980H(b) penalty is adjusted to $4,320.

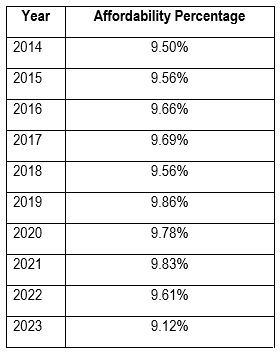

Affordability Percentage will Decrease in 2023

On Aug. 1, 2022, the IRS issued Revenue Procedure 2022-34 to decrease the contribution percentage in 2023 for determining the affordability of an employer’s plan under ACA. For plan years beginning in 2023, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage does not exceed 9.12% of the employee’s household income for the year for purposes of both the pay or play rules and premium tax credit eligibility. This is the most substantial decrease in this percentage since these rules were implemented (down from 9.61% in 2022). Employers may have to substantially lower the amount they require employees to contribute for 2023 to meet the adjusted percentage.

2022 Draft Forms 1094-C and 1095-C – No Substantive Changes for 2022

The IRS released the draft forms for reporting under Internal Revenue Code Sections 6055 and 6056. There were no significant changes to these forms for 2022 in the draft version. These forms from July are draft versions only and should not be filed with the IRS or relied upon for filing. We’ll monitor future developments for the release of the 2022 draft instructions and the release of the 2022 final forms.